In this Blog we read about Fixed Assets Manager in QuickBooks Desktop. QuickBooks Software has revolutionized the financial world by introducing vast features and functionalities to match the business needs. Today, startups can operate on a stable accounting footing without fear of inaccuracy. QuickBooks versions come with multiple functions which are unique to every user.

QuickBooks Desktop Fixed Asset Manager (FAM)

It’s possible to account for all company assets while maintaining a count of all details. QuickBooks Intuit Company has established a significant feature that accounts for every business asset. The Fixed Asset Manager is a comprehensive, unique feature designed for the QuickBooks Desktop.

FAM provides businesses with complete information on the depreciation of their fixed assets. The report helps companies to align their asset details with the IRS Standards. With the Fixed Assets Manager, one can avail different terms such as:

- depreciation methods

- predefined reports

Respective QuickBooks Desktop users must use and understand the terminologies as they are part of asset management details.

Importance of Fixed Assets Manager in QuickBooks Desktop

The fixed Assets Manager facility significantly enhances your business’s asset management. Organizations can experience the following advantages.

- The feature provides users with accurate calculations of asset depreciation.

- It’s easy for businesses to keep an accurate track record of all associated assets.

- FAM allows for proper journal entries.

- The user can generate depreciation forms and reports quickly.

- Fixed Assets help businesses lower insurance costs by using proof of ownership and maintenance records.

- Businesses can quickly improve their tax compliance through proper asset recording.

- The automated Fixed Assets Manager tool eliminated all the manual processes and gave users accountability for every asset.

Required information to help in setting up Fixed Assets Manager in QuickBooks Desktop

Create and set up the Fixed Assets Manager in QuickBooks Desktop. The user needs to provide various details such as:

- Company details: Name and address.

- The account charts

- Official contact details on the Company.

- Business income tax information

- Complete data on the business assets and attached value.

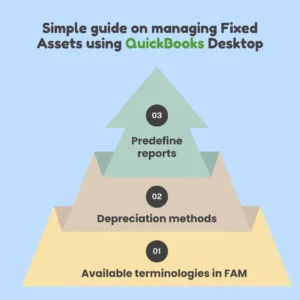

Simple guide on managing Fixed Assets using QuickBooks Desktop Fixed Asset Manager

Available terminologies in FAM

The FAM features work around different terms that assist users in accomplishing the asset details. Businesses need to understand the terms before embarking on the setup process.

- Capitalization limit

This is the amount the user or business should spend on a fixed asset to be considered an asset instead of an expense.

- Depreciation

Depreciation is when the price of an asset goes down. The user should track the loss to help in fixing tax details.

- Fixed asset

The fixed assets are the physical goods that a company owns and have a value of more than one year. The assets should also be higher than the capitalization limit.

- Disposal of Assets

The Disposal asset term means taking Company assets by stealing, selling, or throwing them away.

Depreciation methods

- The method of straight lines or SL

The straight lines method helps allocate the same amount of depreciation to time.

- Declining-Balance method

The Declining Balance method allocates high depreciation expenses to the first years of the asset. Note the first years should have less maintenance. This means the asset should be of value to the company in the first years.

- income tax method or MACRS

Here, businesses use the double-decline balance method. The accounting department should consider the and-half depreciation and return to the straight line method in the asset’s middle life. It takes six years to avail of five years of asset depreciation.

Predefine reports

- ACE adjustment calculations primarily aim to get the total ACE convenor.

- The Amortization Schedule by User Defined: this provides a summary of activities grouped by the user-defined classification and refined assets.

- Amortization schedule by general ledger GL account number: This is used to see the summary of the amortized assets.

- AMT Adjustment Calculation:

- Assets Disposition by Assets Sales Description:

- Assets Basics and Disposal Details Report

- Assets Acquired in the current year.

- Depreciation Schedule by GL Account Number.

- Lead Schedule by G/L Asset Account

- Lead schedule by category

- lead schedule by location

- Monthly G/L Accumulated Account summary.

- remaining basis over remaining life report

- projection by category

Procedure to Setup Fixed Assets Manager FAM

- First, prepare the Income Tax Form:

The user needs to prepare and set the income tax details to help the Fixed Assets Manager avail the asset depreciation in the correct category.

For New User

- Visit your QuickBooks Desktop dashboard to open various options as shown below:

- Proceed to the No Company tab and “Create a new company.”

- Go to the “Detailed Start” to access the “Income Tax Form” option.

- Proceed to the interview steps window and answer all the questions.

- Once the steps are done, the system will create the Company.

Existing user

- From the Company section, press the “My Company” option.

- Click on the “Pencil” icon to continue.

- Go to the “Report information” option and proceed to the “Income Tax Form” for the businesses.

- Review the information and press the “OK” tab.

Procedure to Set up the General Ledger G/L Account in your QuickBooks Desktop

- Fixed Assets Manager facility should apply depreciation to the expense account, which is done in the General Ledger account.

- The feature also provides the sum of the accumulated depreciation and asset value.

- Go to the “Minimal account” to start.

- Next, configure an individual account to set the ideal/minimal account.

- With all the details, the user should have the right General Ledger Account.

The Fixed Assets Manager Wizard

- First, select the options

- “Account Menu”

- “Manage Fixed Assets”.

- Ensure to choose the appropriate solution for your business type.

- The user should provide all mandatory details about the business:

- sync of to and from

- company date

- methods of created assets

Adding assets in FAM

The system will transfer information from QB Desktop Company File to FAM based on the user’s setting.

- On your QuickBooks Desktop, press the “Add” button.

- Next, go to the “F4” or the “Add Asset” option.

- Provide required data such as:

- description

- federal form for depreciation

- general ledger accounts

- Get details on the depreciation calculation, such as cost, tax system, and depreciation method.

Synchronizing Assets

QuickBooks Desktop users can easily synchronize assets automatically or manually.

Automated process

- Go to the “” on your QB Desktop FAM menu.

- Now, choose the automated Asset Synchronization tab when the system opens the new and modified fixed assets items.

- One can refresh the program by pressing “OK” and closing the Fixed Assets Manager.

Manual process

- Go to the “Asset synchronization” and choose the “manually” option.

- Select the “Save Assets to QuickBooks” tab.

- Refresh the program to enable the manual sync process.

- Now, choose the “OK” button and close the “Fixed Assets Manager” option.

- Reopen the option to sync the details and click the “Update Assets” from the QuickBooks software.

The QuickBooks Desktop FAM facility is quite broad and requires proper study to ensure all business assets are well accounted for easy Tax compiling.