As tax season approaches, businesses must ensure they have completed all necessary paperwork to facilitate a streamlined tax process. W2 paper is one such crucial document that offers insights into employee total compensation and results in accurate tax reporting. Notably, larger businesses who wish to precisely input details on the W2 forms may experience difficulty and time-consuming at the same time. That’s where QuickBooks comes into the picture.

QuickBooks is a top-notch accounting software that allows employers to quickly generate and print W-2 forms. Continue reading this blog piece If you are also clueless and want to know how to print w2 in QuickBooks desktop. In this step-by-step guide, we will also discuss the requirements for Printing W-2 Forms in QuickBooks Online that allow you to meet your tax obligations on time.

What is a W-2 Tax Form?

In most countries, all earning citizens are legally obligated to pay an income tax. Such an amount acts as a benefactor sum that the government collects from the citizens and will be used for different purposes, including funding public infrastructure, Development, and welfare projects, social welfare programs, national defense, etc.

A W-2 tax form is a document, also known as the Wage and Tax statement form, that holds all the essential information about employee earnings and tax benefits. Speaking of which, such information is also used to file The Internal Revenue Service( IRS) at the end of the year in the USA. The IRS employs such information to verify individual tax returns and to enforce tax compliance. In simple terms, a W-2 employee is one whose taxes are deducted from his paychecks by his employer, and such information is submitted to the government after that.

The employer is held responsible for providing the W-2 form to all their employees receiving salary, wage, or any other form of compensation. It’s worth mentioning that self-employed individuals or independent contractors don’t require a W-2 form. Instead, they are required to work with a different tax form that includes 1099-MISC or 1099-NEC.

Why is it crucial to withhold tax?

Usually, the employer is responsible for deducting from your paycheck and managing the taxes on the employee’s behalf to meet their obligations promptly. Besides this, such tax collection also facilitates overall contributions to the smoother operation of public services.

Funding of public infrastructure, Development and welfare projects, social welfare programs, national defense, and whatnot.

Hence, the employee has to offer a detailed account that showcases the employee information, total wage deduction for tax purposes, Social Security and Medicare information, and other deductions and benefits, etc. This is where a W-2 form comes into play. As mentioned earlier, such W-2 forms allow employers to calculate the accurate sum at the end of the year to file the returns.

Requirements for Print W2 in QuickBooks Online:

It’s worth mentioning there are a few requirements that you must consider prior to printing W-2 forms in QuickBooks online. Before understanding how to print w2 in QuickBooks desktop, let’s quickly understand the prerequisites. The following are some of the prerequisites that will help you to experience a smooth and accurate printing process:

- Make sure to check whether or not your printer is working well and that you have the printer driver set up correctly. This step helps you to eliminate any potential unknown error that can bother you while printing W-2 forms.

- Users must double-check whether or not their QuickBooks Payroll version shows compatibility with the W-2 form.

- Try to check if your subscription to the QuickBooks payroll is active.

- Remember that black ink is necessary for printing W-2 forms in QuickBooks Online, so ensure you are not running out.

- It’s mandatory that users follow the latest tax table to make sure that their tax calculations are accurate. So, set up the upgraded tax table on the user’s system.

Why to verify the payroll service you are working with prior printing W-2:

It is absolutely necessary to gather some information about the current version of your QuickBooks payrolls that you are working with before starting to print W-2 form in QuickBooks. That’s because, QuickBooks contains different versions and the process of printing W-2 may vary for each version so it’s always ideal to at least get clear understanding about your current QuickBooks version. However, if you think you don’t know the current version of your QuickBooks online and it is recommended to follow the above mentioned steps:

- Begin with signing in to the QuickBooks online.

- Now, open the setting and choose the accounts and setting option along with billing subscription and payroll.

- Click on plan details, now you can see all the details regarding your payroll plan that you currently have.

- In case, it displays basic or enhanced it demonstrate QuickBooks self service payroll

- If it is a full service payroll that simply indicates you have a QuickBooks full service payroll version.

Steps How to Print W-2 in QuickBooks Online

Wondering how to print w2 in QuickBooks desktop? Well, Fortunately, with the help of QuickBooks online the users can easily and efficiently print the W-2 forms. However, there are few steps that you must follow to seamlessly generate W-2 form.

- Navigate the QuickBooks online with the help of a web browser.

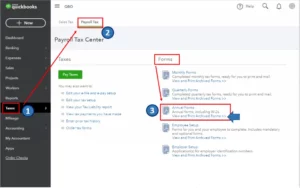

- Now, open the Payroll text center and follow the following steps.

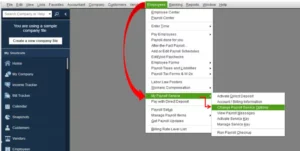

a) Choose the employees option and after that click on the Payroll Centre

b) Now, navigate the tab file forms and choose the View/Print Forms & W-2s option.

c) Now, enter the payroll PIN.

3. Once you are done with this, click on the next W-2 tab.

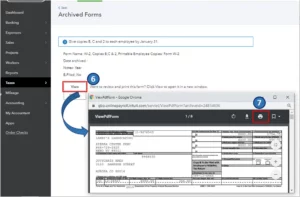

4. Now, you will see a dialog box which has the detailed information of the employees, choose the employee name whose form has to be generated. Alternatively, you can also choose all from the checkbox.

5. Now, choose the Open/Save Selected.

6. Upon selecting the print option, a print Instructions page will appear. Please specify the reason for printing the form.

7. Now, you will see a dialogue box that will instruct the user to load the paper into the printer. However, make sure to provide your employees with instructions that they require to follow while filing the taxes. Hence, it would be helpful to load papers that have instructions printed on them so that the whole process will get easier for the employees.

8. A more comprehensive version of the file will appear in a pdf file format. Now, you must go through the document carefully to check whether or not the information is accurate. If the information is correct and does not require any adjustment then print the form.

9. The final step would be to go to File and then opt for the Print option.

Wrap Up

W2 paper is one such crucial document that not only offers insights into employee total compensation but also results in accurate tax reporting. That’s where QuickBooks Online comes into play. QuickBooks online is a top notch accounting software that facilitates the employer to generate and print W-2 forms and also enable the users to experience a streamline printing process.

However, if you are not able to follow the instructions chances are you might feel stuck and bothered. So, in such cases you can look for professional help who can help you with your QuickBooks online related queries and allow you to have a smooth printing process. Alternatively, you can also get support through visiting their website. By doing so, you can expect to get in touch with QuickBooks payroll support experts who can help you easily get your W-2 forms printed.