QuickBooks software’s primary aim is to advocate for secure, easy, and reliable payments, transaction recording, and general bookkeeping services. Businesses can get a sigh of relief regarding money management strategies. QuickBooks goes beyond the accounting and bookkeeping services to merge with electronic payment services for fast, secure transfers.

The accounting software helps remove all financial uncertainty by incorporating secure payment modes such as ACH. This allows small and medium businesses to soar securely in the business industry without accounting hassles. QuickBooks is designed to offer quick solutions for different business needs.

ACH in QuickBooks

The Automated Clearing House Payments is a popular payment facility that helps in sending and receiving funds electronically. The ACH payments are incredible solutions for many businesses seeking online or electronic fund transfers. It’s a great facility that eliminates paperwork and physical money transfers and helps in recording.

Intuit QuickBooks developer is keen to offer inclusive accounting services by linking QBs to the ACH system. The Automated Clearing House comes with major advantages that suit all business levels at affordable prices.

Benefits of ACH payments

- The system helps secure payment services such as sending and receiving money. Companies or individuals can send funds between bank accounts seamlessly.

- One can conduct direct deposits.

- It’s easy to set the debit and credit card transactions.

Does QuickBooks charge for the ACH payments?

Though QuickBooks and ACH are a great match. There is always a lingering question from QuickBooks users. Does the software charge for ACH payments? Like any other payment service, transactional fees apply based on the software or system developers.

With QuickBooks, a small fee is charged for ACH payment services. This helps the user understand different transaction fees and their impact on their business. To clear the doubts, QuickBooks charges a 1% for a single transaction on various bank payments.

The charges are counted as $10 per transaction, regardless of the amount. However, the amount doesn’t go beyond the set amount. Taking into consideration the benefits ACH offers, especially for bulk transfer. It’s among the best financial transfer facilities. Enterprises get the privilege to access ACH via the QuickBooks system.

What does ACH fee cover?

The QuickBooks ACH payment charges are directed to data transmission for the systems Networks and reconciling and processing the payment.

ACH payment processing

The electronic fund transfer involves a credit and debit account of the merchant and client. To avail a successful transfer, customers need to provide various details such as:

- Banks ABA routing number

- Bank account

- Account type.

The ACH transfer processing days differ based on the bank or payment facility. Some transactions take 1 to 5 days while others work in next-day deposit.

Quick steps to record ACH payments on your QuickBooks system

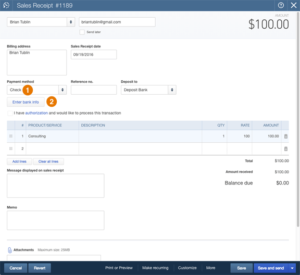

QuickBooks software is swift on all accounting activities, allowing users to save, schedule, and record all financial details. Each QuickBooks version is unique and can conduct numerous services. To record the ACH payments, one can use either of the methods below.

- On the QuickBooks software, select the check. One can also select ACH payment method used during the recurring or one-time sale receipt took place.

- Next, provide the information of the client such as bank account.

- Authenticate the bank account details to proceed.

- Enter mandatory data on the provided form to process the transfer.

- The payment will be complete and recorded.

Method 2

- Go to the “sales” section and view whether the page has selected the invoices.

- Now, proceed to the “Receive Payment” option next to the invoice you want to use.

- The system will display the receive payment page.

- Enter outstanding transactions and select the “Save and New option or the ‘Save and Close” tab.

Procedure to conduct QuickBooks ACH Vendor payments

Besides the client payment process, one can also record an ACH vendor payment in QuickBooks as follows:

- Proceed to the “Pay Bills” from the Vendors menu.

- Pick the “AP account” from the list.

- Next, click the checkboxes for all bills that you wish to pay.

- The user should proceed to apply a discount or credit to the bills.

- Create a date to pay the necessary bills.

- Select the ACH payment or check.

- Ensure to have the bank routing details.

- Recheck the information and select the “selected Bills” or click “Done” or “Pay More Bills.”

QuickBooks ACH fees

For companies processing huge amounts of transactions can feel the pinch of utilizing ACH payments. However, Automated Clearing House payments have a particular fee for all transactions regardless of the amount.

To save on the charges, businesses can opt for a better monthly plan like the $20. QuickBooks software provides a comprehensive list of payments. The QuickBooks online and desktop versions are defined as follows:

- QuickBooks Online

The ACH payment in QuickBooks fee is standardized to 1%, which is a max of $10 plus 25 cents for every transaction. This applies to both the $0 monthly plan and the $20 monthly payment plan.

- QuickBooks Desktop

QB Desktop version offers $3.00 per ACH+30 cents per transaction. The price goes for the $0 monthly payment plan and $20 monthly plan.

To get the actual ACH charges, the user should request the financial institution whether there are additional fees for the transactions.

However, QuickBooks has additional charges for different services like invoice processing through Intuit merchant services.

QuickBooks extra charges for other services:

QB Online

- A 2.90% + 25 cents transaction fee for the $0 monthly plan and 2.80 % for the $20 monthly plan.

QuickBooks Desktop

3.50% +30 cents for every transaction for the $0 monthly plan and 3.30% for $20 monthly plan.

Other charges

- Transaction and full chargeback fee: $25

- ACH/Electronic Bank Reject fee: $25

- Refund Check fee: $10

- Penalties, fines, and other fees: the merchant pays for the fines.

Ways to avoid QuickBooks processing fee

The charges are designed to help in transferring and paying for various services within the system. However, one can decide on a manual process, which is tiring. It’s possible to cut the charges through third-party tools to make financial transfers.